In place of most other reasonable- and no-advance payment mortgage applications, there are no unique guidance to utilize an FHA financial. Such, brand new Institution of Veterans Issues assures new Virtual assistant mortgage but only in order to members of the fresh new army. And also the USDA financing need consumers having average or lowest earnings and also to buy within the an eligible rural city.

Whilst FHA home appraisal conditions was stricter compared to those of traditional mortgage loans, you’ll find fewer unique conditions. You can use FHA mortgage loans regardless of where you live, what you carry out, and you will what you secure.

The brand new FHA understands not totally all home is disperse-when you look at the able. Specifically for first-day homebuyers looking to purchase with the lower avoid out-of the housing market. This is exactly why they created the FHA 203(k) rehabilitation financing.

The latest FHA 203(k) loan facilitate consumers buy a beneficial fixer-top and financing the purchase price otherwise solutions in one go. Make use of the additional loans to help you upgrade appliances, replace flooring, exchange a roof, paint bed room, and a lot more.

Since the you may be funding our home solutions with your financial, you will not need to pay initial when you look at the cash or take aside a separate loan. This will save some costs and you may day when purchasing a more affordable family that really needs particular work to feel livable.

Downsides from FHA funds

However, the fresh new FHA mortgage isn’t really instead the disadvantages. Although it keeps novel benefits getting home owners, there are lots of things you should believe before you choose a keen FHA mortgage.

The tiniest deposit you possibly can make for a keen FHA mortgage are step 3.5% of your own cost. Conventional funds go a tiny lower, which have advance payment criteria performing at just step three%. That might appear to be a tiny difference. However, 0.5% of an excellent $250,000 financing is $1,250. That could be a deal breaker if you’re focusing on a great limited income.

FHA home loan top (MIP) is actually mandatory. If one makes a down payment smaller compared to ten%, you might be caught that have home loan insurance policies toward life of the loan. If one makes a downpayment bigger than ten%, you pay MIP for 11 ages.

As well, a traditional loan’s individual mortgage insurance coverage (PMI) are terminated as soon as your loan reaches 80% loan-to-worth proportion. In other words, it goes aside without difficulty once you have based adequate guarantee from the domestic.

You can also find eliminate FHA home loan insurance policies once you have repaid the borrowed funds balance as a result of 80% of one’s house’s really worth. But to take action, you’ll need re-finance. That will set you back currency and you will starts the loan more than right away.

If financial insurance policy is a primary question to you personally, you could like the lowest-down-percentage old-fashioned mortgage in lieu of an enthusiastic FHA loan.

step three. FHA fund enjoys all the way down loan constraints

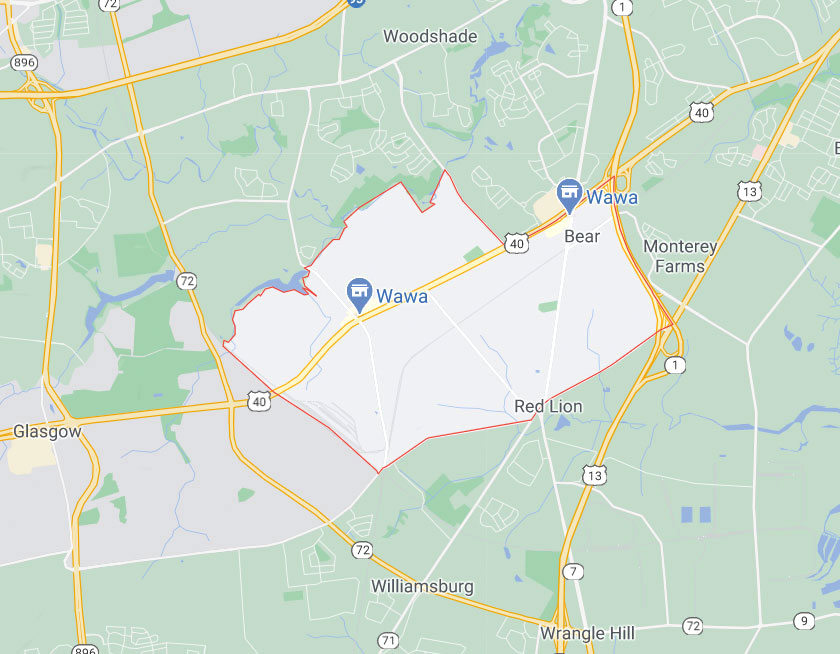

The fresh FHA enforces stricter mortgage limitations compared to almost every other financial options. In the most common towns, FHA money is capped at $ to possess an individual-house. In comparison, traditional money is actually capped at the $ . Each other financing types make it highest mortgage constraints when you look at the costly home markets for example Seattle, Bay area, and you will New york city.

When you’re shopping from inside the a costly market – and you’ve got the credit rating to obtain recognized for a good huge mortgage – you will want a traditional or jumbo financing for the the new house buy. An enthusiastic FHA mortgage might not be large enough.

Why does the newest FHA mortgage program really works?

The brand new Federal Property Management – additionally also known as FHA – falls under the You.S. Company from Casing and you may Metropolitan Invention. The first thing to discover is the fact that FHA try a mortgage insurer – perhaps not a home loan company. That is a significant differences. This means browse around these guys you can purchase a keen FHA-covered financing regarding almost any mortgage lender you want.